Regardless of being a novice or an experienced seller, this guide covers all aspects necessary for success on Amazon, from account setup to identifying profitable niches and optimizing listings for maximum sales.

I. Introduction

Amazon’s online marketplace has emerged as a major player in e-commerce, drawing millions of buyers and sellers from across the globe. As an increasing number of customers turn to Amazon for their shopping needs, the platform presents a significant opportunity for entrepreneurs and businesses to access a worldwide audience and boost their sales.

Selling on Amazon offers various benefits, such as reaching an extensive customer base, secure payment processing, and robust tools for optimizing sales and monitoring performance. Additionally, Amazon’s fulfillment services, like the popular Fulfillment by Amazon (FBA) program, supply sellers with logistical support to streamline operations and save time and money.

This article delves into the process of becoming an Amazon seller and highlights key considerations and best practices for success on the platform. Whether a small business owner aiming to broaden their reach or an individual launching a side venture, selling on Amazon can be a profitable and gratifying endeavor.

II. How to Become an Amazon Seller

The process of becoming an Amazon seller is relatively simple, involving a few straightforward steps. Here is an overview of the process:

- Go to the Amazon Seller Central website and click on the “Register Now” button.

- Follow the prompts to create your Amazon seller account, including providing your personal and business information, setting up payment methods, and choosing a product category to sell in.

- Once your account is created, you can start creating product listings and managing your inventory in the Amazon Seller Central dashboard.

While the process of creating an Amazon seller account is relatively simple, it’s important to note that there are certain requirements and guidelines that sellers must adhere to in order to sell on the platform. For example, Amazon requires sellers to have a valid bank account and credit card, and may also require additional information such as tax identification numbers and business registration documents. Additionally, Amazon has strict rules around product listings and customer service, which sellers must follow to avoid penalties or account suspension.

By following Amazon’s guidelines and best practices, however, sellers can tap into a massive customer base and potentially achieve significant sales growth. In the next section, we explore some of the key requirements and guidelines for selling on Amazon in more detail.

III. Amazon Seller Fees and Calculators

One of the most important factors for Amazon sellers to consider is the fees associated with selling on the platform. Amazon charges a range of fees for different types of transactions, including referral fees, fulfillment fees, and subscription fees for certain seller plans. These fees can add up quickly and eat into sellers’ profits, so it’s important to understand how they work and how to minimize them where possible.

Referral fees, for example, are fees that Amazon charges for each item sold, based on a percentage of the item’s sale price. These fees vary depending on the product category, but can range from 6% to 45% of the sale price. Fulfillment fees, on the other hand, are charged for products that are stored in and shipped from Amazon’s warehouses, and can include fees for storage, order fulfillment, and shipping.

To help sellers estimate their costs and potential profits, Amazon offers several fee calculators and other tools within the Amazon Seller Central dashboard. These tools allow sellers to input their product information and receive an estimate of the fees associated with their sales. By using these tools, sellers can better understand their costs and adjust their pricing and inventory strategies accordingly.

IV. Amazon Seller Tools and Resources

In addition to fee calculators, Amazon offers a range of other tools and resources to help sellers optimize their sales and improve our businesses. Here are a few key examples:

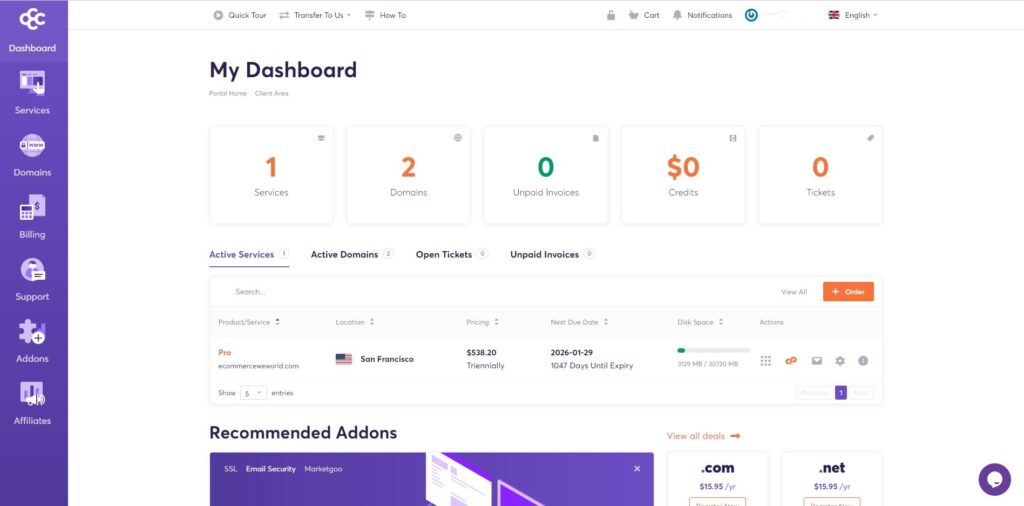

- Amazon Seller Central: This is the central hub for Amazon sellers, where we can manage their inventory, track their sales, and access a range of reporting and analytics tools.

- Amazon Seller University: This is a free training and educational resource for Amazon sellers, offering courses and tutorials on topics such as listing optimization, advertising, and fulfillment.

- Amazon Seller Forums: These are online forums where Amazon sellers can connect with one another, ask questions, and share best practices.

- Amazon Advertising: This is a suite of advertising tools for sellers to promote their products on Amazon, including sponsored ads and display ads.

By taking advantage of these tools and resources, sellers can gain insights into sales performance, improve our product listings, and connect with other sellers to share ideas and best practices. In the next section, we explore some of the best products to sell on Amazon, and provide tips for sellers to identify profitable niches and optimize our listings for maximum visibility and sales.

V. Best Products to Sell on Amazon

When it comes to choosing the best products to sell on Amazon, there are several factors to consider. Some of the types of products that tend to do well on Amazon include:

- Popular consumer products: Products that are in high demand among Amazon’s massive customer base can be lucrative opportunities for sellers.

- Niche products: Products that cater to a specific audience or meet a unique need can be profitable for sellers who can find the right target market.

- Private label products: Products that are unique to a particular seller, and are not sold by other sellers on Amazon, can provide a competitive advantage and potentially higher profit margins.

To find profitable niches and optimize their listings for maximum visibility and sales, Amazon sellers should consider using a range of tools and strategies. For example, sellers can use Amazon’s Best Seller Rank (BSR) to see which products are currently selling well, and identify potential opportunities in related niches. Additionally, sellers can use Amazon’s search engine optimization (SEO) tools, such as keyword research and product listings optimization, to improve their visibility and ranking in search results. In the next section, we discuss Amazon seller ratings and feedback, which can play a critical role in a seller’s success on the platform.

VI. Amazon Seller Ratings and Feedback

Amazon’s seller rating and feedback systems are critical to a seller’s success on the platform. When a customer purchases a product from a seller, they have the opportunity to leave feedback and rate the seller on a scale of one to five stars. This feedback and rating can be seen by other potential customers, and can significantly impact a seller’s visibility and sales on the platform.

To improve their ratings and feedback, sellers should prioritize providing high-quality products, accurate product descriptions, and excellent customer service. They should also monitor their ratings and feedback closely, and respond promptly to any negative feedback or customer complaints. By taking these steps, sellers can increase their visibility and sales on Amazon and establish a positive reputation among customers.

VII. Taxes and Legal Considerations for Amazon Sellers

Selling on Amazon can have important tax and legal implications for sellers. For example, sellers may be required to register for sales tax in certain states, and to collect and remit sales tax on their sales. Additionally, sellers may need to choose the right business structure for their Amazon selling business, such as forming a limited liability company (LLC) or operating as a sole proprietorship.

To ensure they are compliant with all relevant laws and regulations, Amazon sellers should consult with a tax or legal professional, and stay up-to-date on any changes to tax laws or regulations that may affect our business. We should also maintain accurate records of our sales and expenses, and file taxes in a timely and accurate manner. By taking these steps, sellers can avoid penalties and legal issues, and focus on growing our business on Amazon.

VIII. Conclusion

Becoming an Amazon seller presents an excellent opportunity to initiate or expand a business and access a vast, growing market. By adhering to the guidelines and best practices discussed in this article, sellers can optimize their sales and profitability on the platform. To recap, some crucial points for aspiring Amazon sellers include:

- Understanding the requirements and guidelines for selling on Amazon

- Minimizing fees and costs associated with selling on the platform

- Utilizing Amazon’s seller tools and resources to optimize sales and improve business performance

- Prioritizing high-quality products and excellent customer service to improve ratings and feedback

- Staying compliant with tax and legal requirements, and seeking professional advice when necessary

- Identifying profitable niches and optimizing listings for maximum visibility and sales.

With these strategies in place, Amazon sellers can explore the opportunities provided by Amazon’s marketplace and begin building their own successful businesses.